Many people have had to alter their budgets to accommodate recent increased interest rates, alongside the growing property prices in many areas of the country. But how does our current environment compare to previous generations?

As Loan Market turns 30, we took a look back to see how the market has changed from 1994 to today.

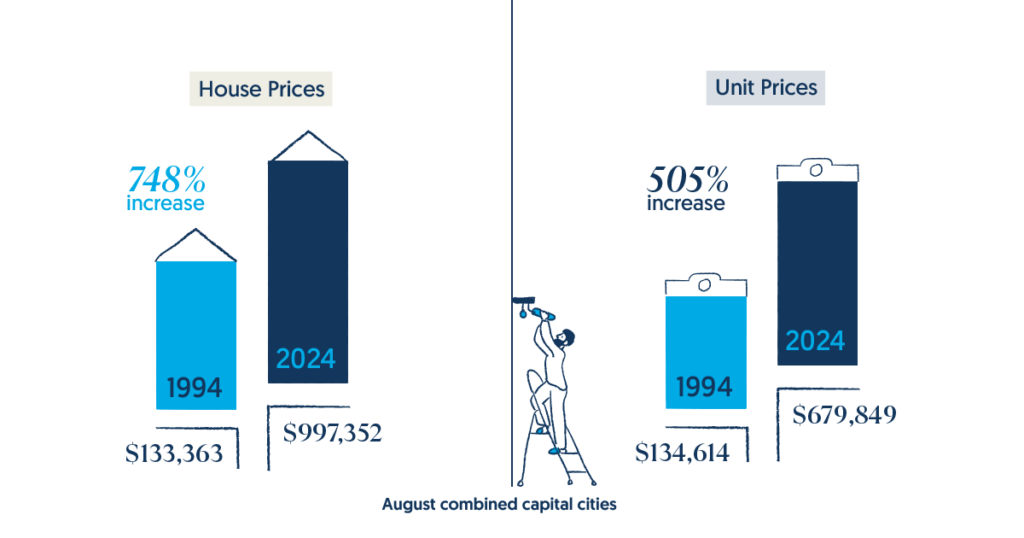

House prices

In August of 1994, the average house price in capital cities was $133,363. Fast forward to August 2024 and that average was $997,352. An increase of 748%.

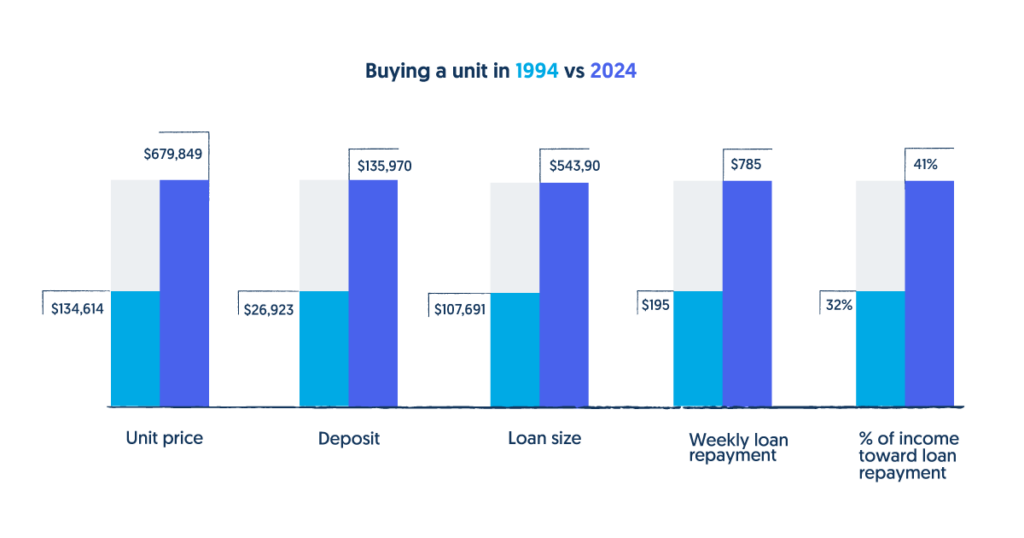

In the same time, the average unit price in capital cities has changed from $134,614 to $679,849 – an increase of 505%.

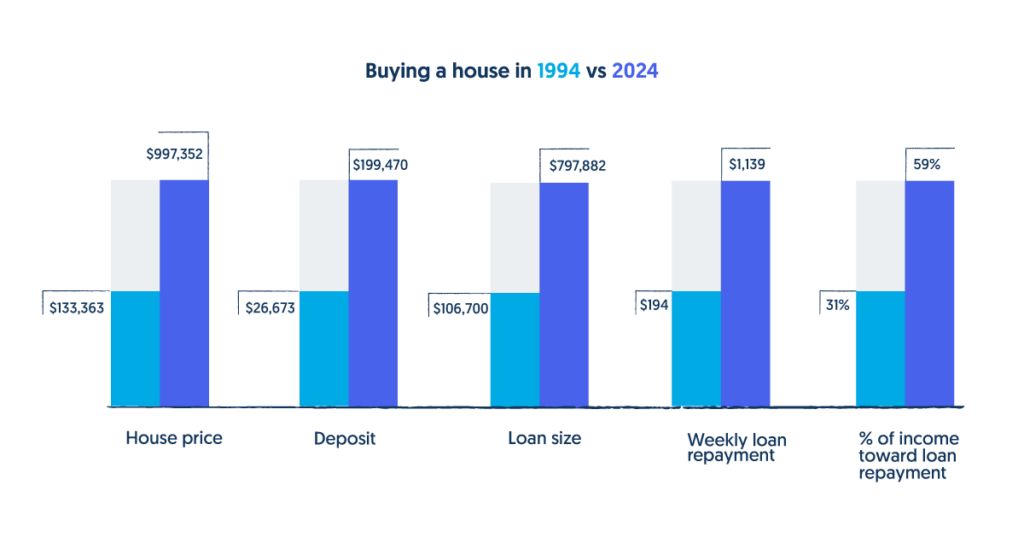

Deposit size

Based on the average property prices, a 20% deposit for a house in 1994 was $26,673, compared to $199,470 in 2024. For a unit, this has changed from $26,923 in 1994 to $135,970 in 2024.

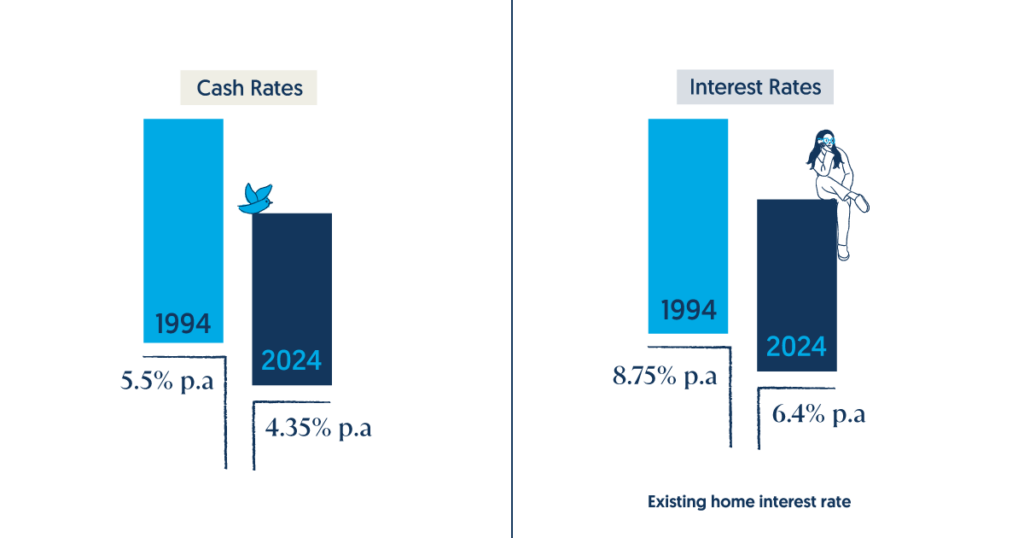

Interest rates

In June 1994, the average interest rate on an existing home loan was 8.75% p.a.. In June 2024 this was 6.4%p.a.. Interest rates were higher in 1994, and in 1995 they hit a peak of 10.5%.

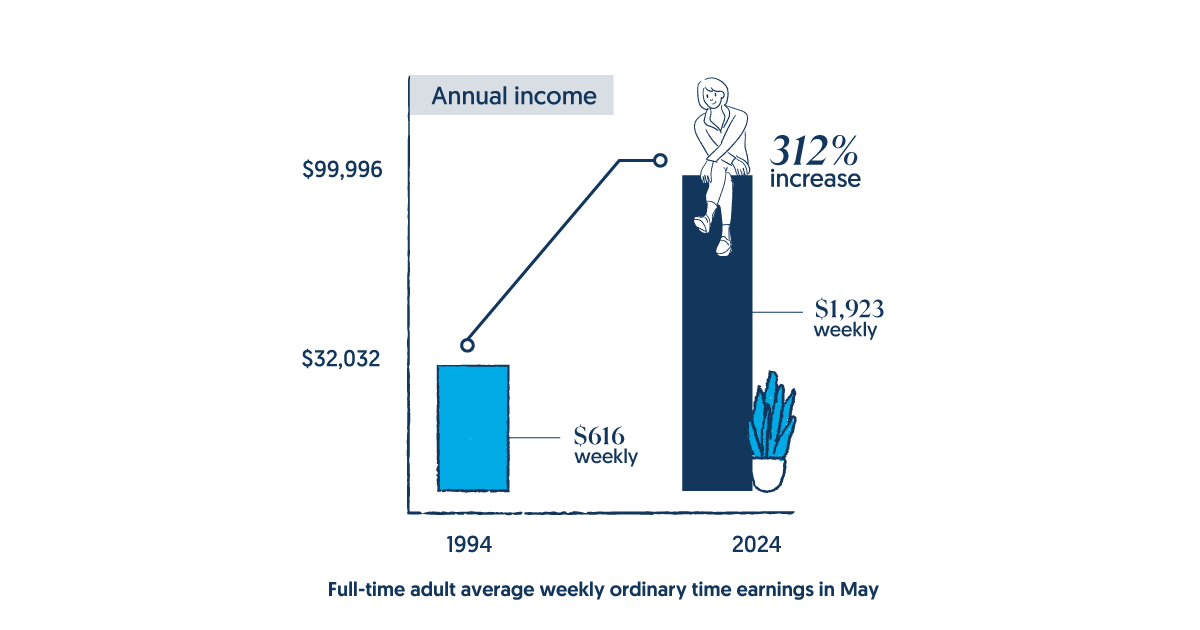

Average income

While we can see there has been a significant increase in property prices, we need to take a look at the average income to get a feel for how long this may have taken to save for and how much of the household income went toward paying the loan.

In May 1994, the average weekly ordinary time earnings was $616, which is $32,032 annually. In May 2024, the average was $1,923, or $99,996 annually. This is an increase of 312%.

How does this all compare?

Based on this data, approximately 43 weeks of income was needed in 1994 to save for a house, compared to 104 weeks in 2024. And once the house was purchased, around 31% of the weekly income went toward the loan repayments in 1994. In 2024, this number was 59%.

Looking at units, around 44 weeks of income would pay for a 20% deposit in 1994. In 2024 it was 71. In 1994, 32% of the weekly income went towards loan repayment compared to 41% in 2024.

Guiding you home since 1994

In 1994, mortgage broking was only just beginning in Australia. We grew from having one bank on offer to today having a panel of over 60 to compare. Despite the market conditions changing, we have been by your side for 30 years. From buying your first home to growing an investment portfolio, or adding a new car to your driveway, we help Australians get the right finance to achieve their goals. With over 70% of Australians now choosing to get their home loan through a broker, we’re proud to help you navigate the changing market today, tomorrow and into the future.

Want to speak to a broker to help you achieve your financial goals? Find a broker today and get started.